“I kept delaying investments thinking I didn’t earn enough.” — A Late Starter in Her 30s 🔗

When we met Radhika, she was 34 and earning well but hadn’t started investing. She believed that investments were for people earning “big money.” Despite saving regularly, her money sat idle in her bank account.

We walked her through a basic goal-mapping exercise and showed her how even modest SIPs could work over time. We helped her begin with simple mutual fund investments linked to short- and long-term goals.

Within a year, Radhika was confidently investing 20% of her income, with clear targets for her future. She often says, “ I wish I'd started earlier, but I'm glad I didn't wait any longer. ” Now, she’s a proud owner of a small portfolio.

“I was investing randomly, without knowing why.” — The Portfolio Drifter 🔗

Raj, a 42-year-old salaried professional, came to us with over 15 mutual funds, picked mostly on advice from friends and online influencers. His portfolio looked busy, but lacked direction.

We helped him consolidate his holdings, understand his actual risk appetite, and streamline his portfolio to just a handful of funds aligned with his key life goals.

Raj now has a focused investment strategy and reviews his portfolio only twice a year—no more chasing “hot tips” or reacting to market noise.

“We were saving for our child, but had no structure.” — The First-Time Parents 🔗

Neha and Akshay had been saving irregularly for their daughter’s education but weren’t sure how much was enough or where to invest.

We helped them define a time-bound target, account for inflation, and start a disciplined SIP plan with yearly top-ups. We also guided them on maintaining a separate emergency fund.

Today, their child’s education fund is on track, and they’ve found financial clarity and peace of mind as new parents.

“I used to withdraw every time the market fell.” — The Nervous Investor 🔗

Arvind had been investing for years but struggled to stay invested during market downturns. Every correction led to panic selling and missed opportunities.

We set up a structured SIP approach, spaced out his lump sum investments, and built in automatic rebalancing. More importantly, we kept him informed and focused on long-term thinking—especially when volatility struck.

In the last market dip, Arvind stayed invested for the first time. He now sees volatility as a part of the journey, not a signal to exit.

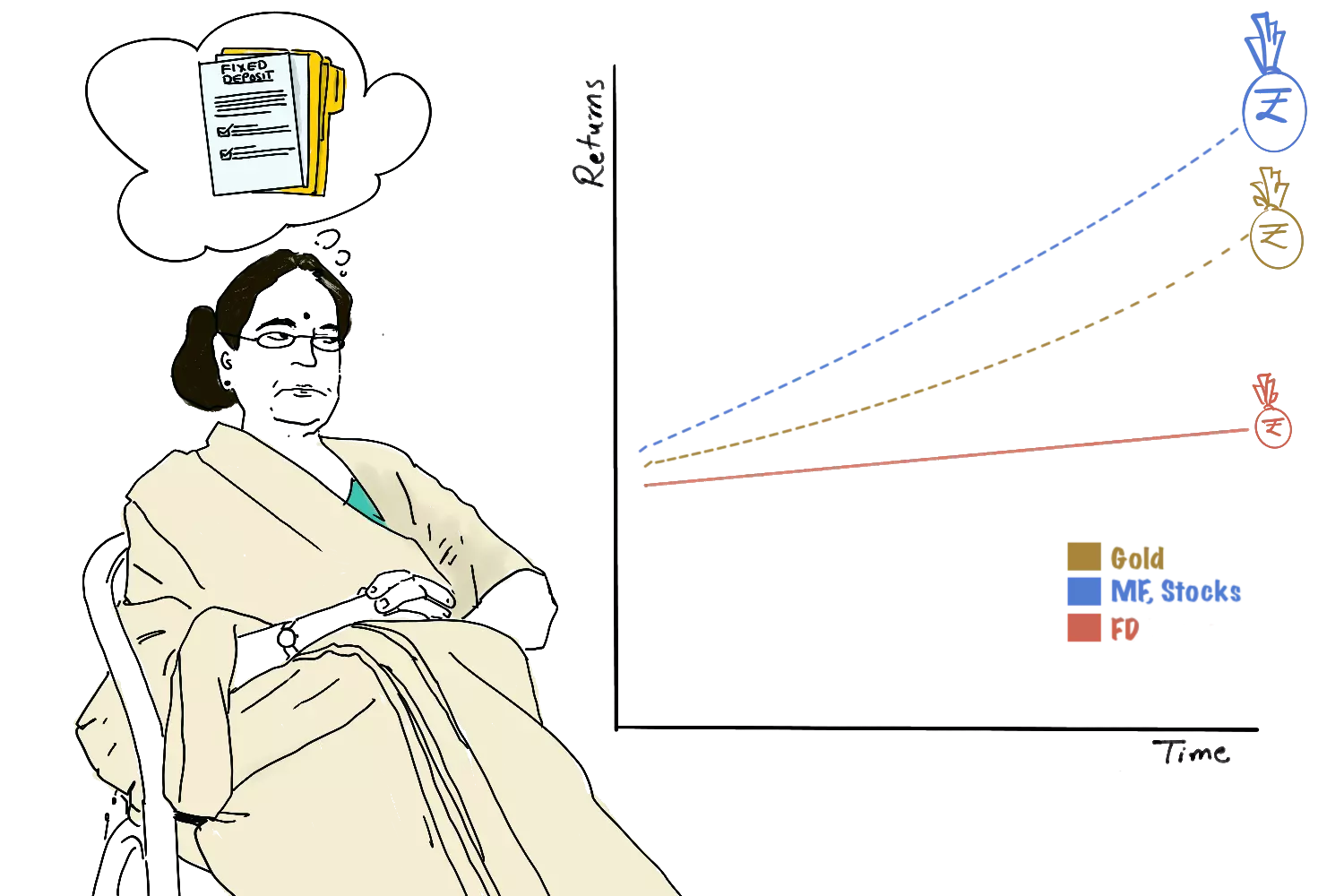

“I had money in FDs but didn’t know better options existed.” — The Ultra-Conservative Saver 🔗

Sarla, a 55-year-old retiree, had parked most of her life savings in fixed deposits. While secure, her returns barely kept up with inflation.

We introduced her to low-risk debt and hybrid mutual fund options, explaining how she could aim for better post-tax returns without compromising on safety or liquidity.

Her portfolio now earns more efficiently, and she has access to funds when she needs them—without locking everything into long-term deposits.